The Rise of Contactless Payments

In recent years, the world of finance has witnessed a significant shift towards contactless payment methods. This revolution in how we transact is reshaping the landscape of traditional payment systems, offering unprecedented convenience and speed.

What Are Contactless Payments?

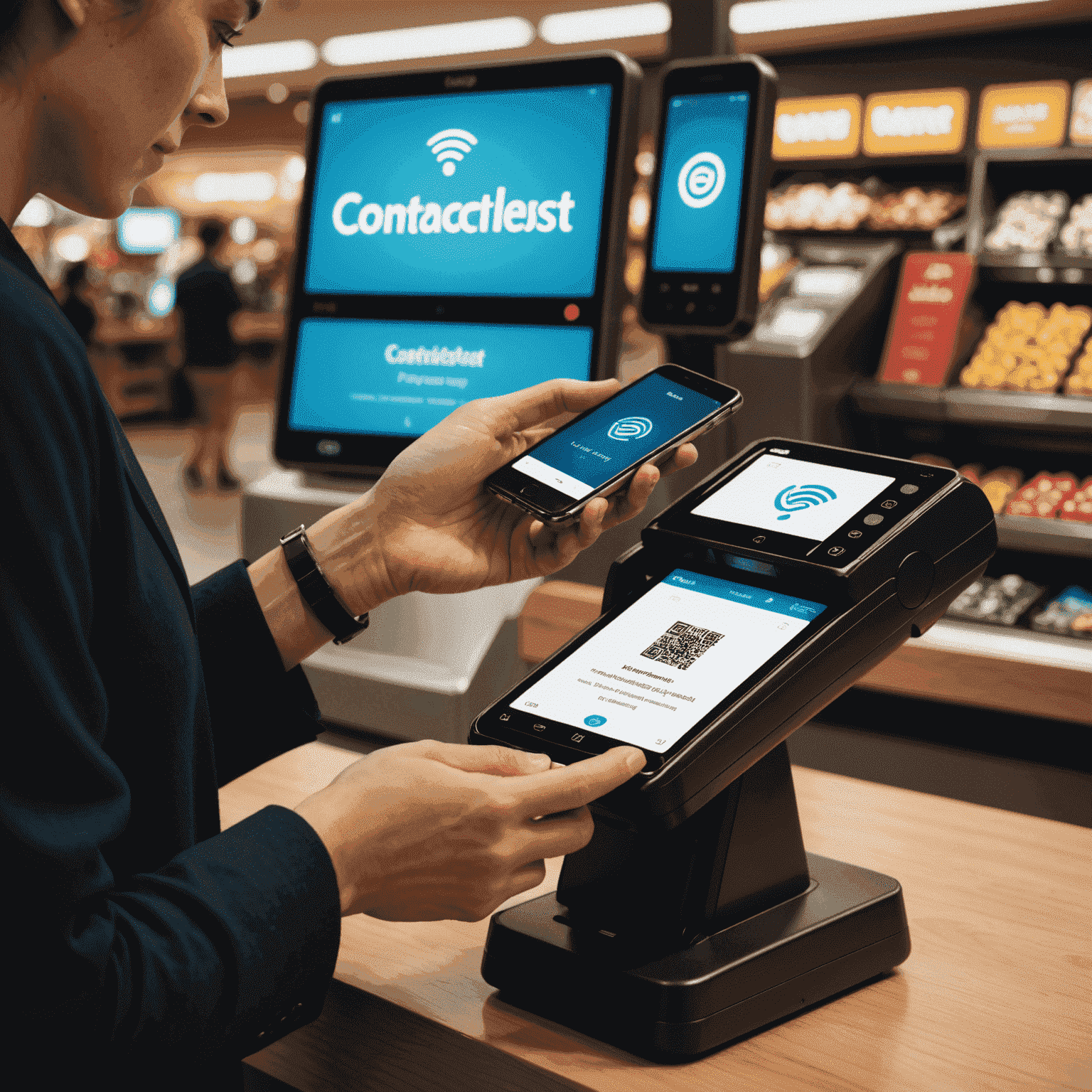

Contactless payments allow consumers to purchase goods and services by simply tapping their card, smartphone, or wearable device near a payment terminal. This technology utilizes Near Field Communication (NFC) to securely transmit payment information without the need for physical contact.

The Advantages of Going Contactless

- Speed: Transactions are completed in seconds, reducing queue times.

- Convenience: No need to carry cash or remember PIN codes.

- Hygiene: Minimizes physical contact, which is particularly relevant in a post-pandemic world.

- Security: Advanced encryption protects user data during transactions.

Impact on Traditional Payment Systems

The surge in contactless payments is challenging the dominance of cash and traditional card transactions. Banks and financial institutions are adapting their services to meet this growing demand, with many offering contactless-enabled cards and mobile payment options.

The Future of Contactless

As technology continues to evolve, we can expect to see further innovations in contactless payments. Biometric authentication, such as fingerprint or facial recognition, may become more prevalent, offering even greater security and convenience.

Moreover, the integration of contactless payments with other technologies, like the Internet of Things (IoT), could lead to seamless transactions in smart homes and cities. Imagine your refrigerator automatically ordering and paying for groceries when supplies run low!

Embracing the Change

For consumers and businesses alike, adapting to this contactless revolution is becoming increasingly important. Companies like Batelco are at the forefront, offering services such as Batelco quick pay and Batelco recharge options that leverage contactless technology for faster, more efficient transactions.

As we move further into the digital age, contactless payments are set to become the norm rather than the exception. By embracing this technology, we're not just changing how we pay – we're redefining the very nature of transactions in our increasingly connected world.